- AI Agent

AI agent for customer verification (KYC)

The AI agent for verifying customers (KYC) is designed to streamline compliance and verification processes in the financial services and banking sectors. Primarily positioned in operations departments, this agent facilitates critical validation tasks to ensure compliance with regulatory standards.

Fraud detection accuracy

Shortening onboarding time

Savings in compliance costs

- Workflows

Key workflows for verifying compliance

This AI agent automates critical processes such as power of attorney verification and commercial registry checks. By performing these essential verifications, the KYC agent ensures that all customer interactions comply with legal requirements, thus supporting risk management and compliance efforts.

- Workflows

Match candidates to roles instantly

This agent receives resumes from your ATS or email inbox and evaluates them against open job descriptions. They highlight the best matches, flag potential fits, and remove unqualified candidates from the list.

The agent improves with each task, adapts to the results, uses feedback, and corrects itself using Constitutional AI.

Through constant feedback loops, Nrpath AI agents improve their approach with each cycle, resulting in 98% accuracy across all processes.

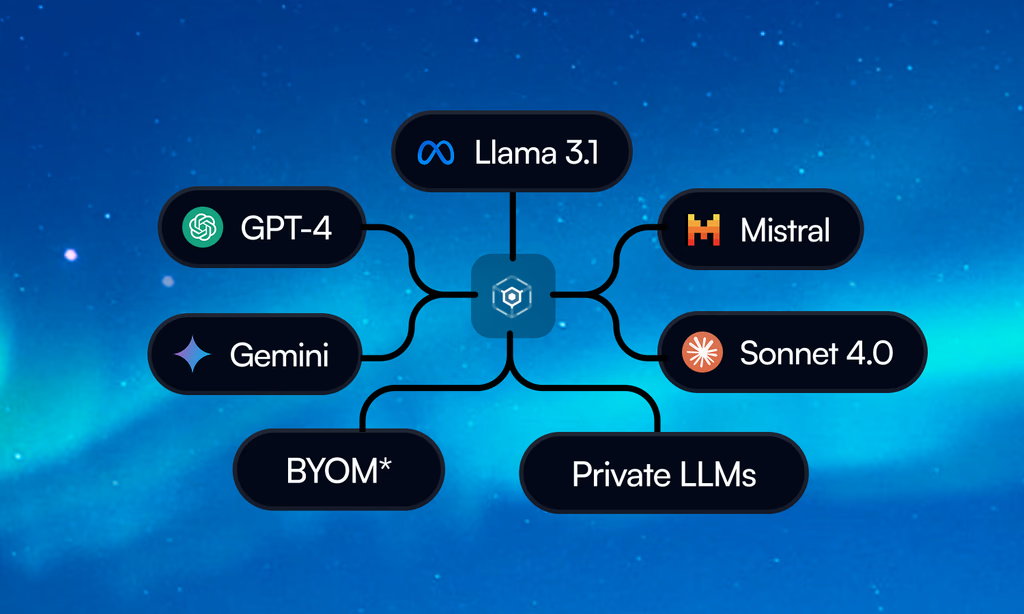

We call it ModelMesh. Each agent selects the right model for the task, balancing speed, accuracy, and cost in real time.

The platform’s intelligent agents learn and adapt over time, refining processes and contributing to a culture of continuous improvement. As a result, businesses not only save time but also gain a competitive edge by responding faster to market demands and customer needs.

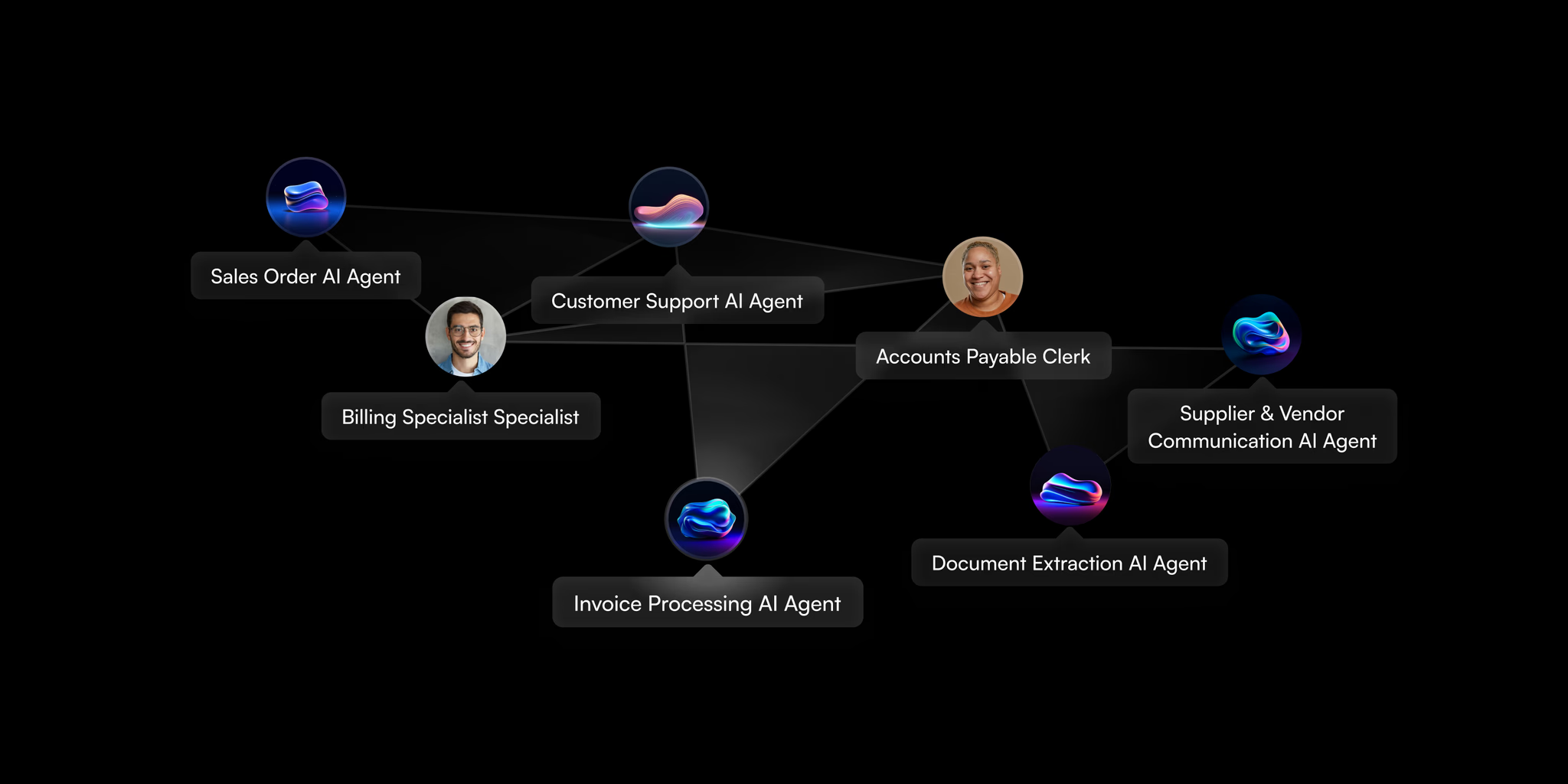

- Multi-Agent

Multi-agent for end-to-end compliance

In collaboration with other AI agents, the KYC verification agent contributes to a multi-agent system that ensures a thorough and precise approach to customer validation tasks. This collaboration improves the overall accuracy and efficiency of the KYC processes.